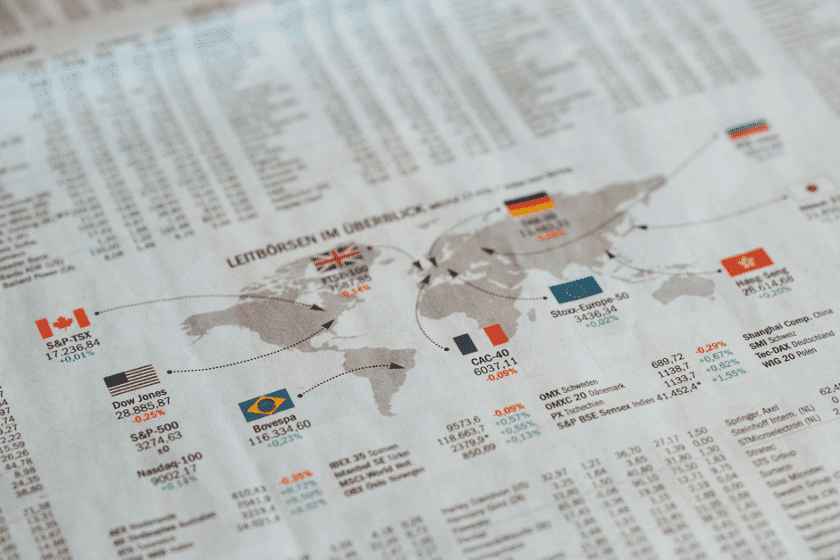

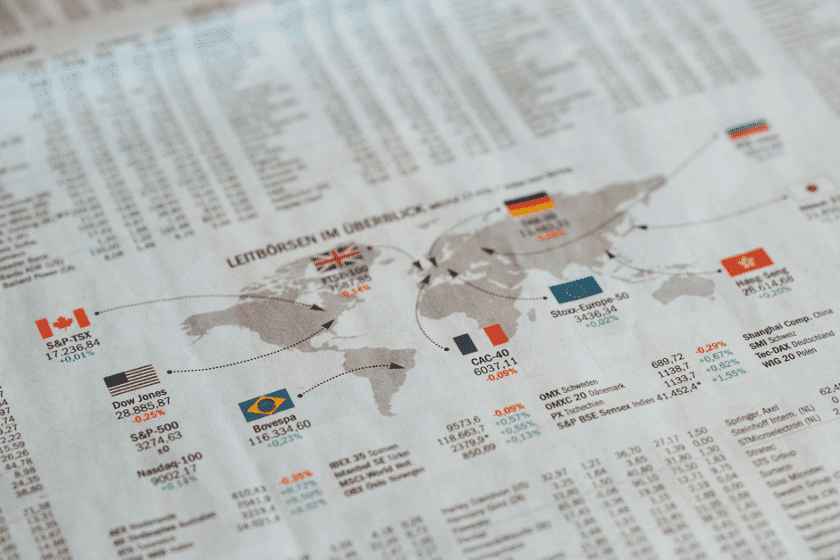

Every investor has a slightly different philosophy when deciding how to manage and direct their funds. Some of us look for long, slow gains; others seek to capitalize on the rapid growth of emerging markets. What underpins every investment philosophy is seeking a good return on the investment — in other words, making money.

Whatever your approach, a degree of prudence is essential to any investor. Carelessness is how you lose money, and nobody wants that. Here are some tips that hold as true for explosive growth as they do for steady bets.

1) Do the Recon

So you’ve heard of a hot new investment opportunity through the grapevine. What do you do? You investigate. Thoroughly and through every channel that you can use.

Talk to contacts. Use the internet to search out reviews from trusted review sites. Read every word on there, and draw your own conclusions; compare the various information you find and decide if this is a responsible investment.

Always remember that there’s a difference between investing in something with substantive potential but an uncertain future, and investing in a bogus fund or a scam. Risk can pay off, but the dodgy business never pays off for investors in the end.

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

Trustworthy review sites are a godsend for this reason. For example, if you were looking to invest in BDSwiss, finding a quality BDSwiss review, or ten, will give you useful information. You can use this as a basis for whether you want to invest or not.

2) Don’t Put All Your Eggs in One Basket

2) Don’t Put All Your Eggs in One Basket

This cautionary note goes out especially to the slow-and-steady types, which may seem surprising. Isn’t this advice that those looking for quick gains need to hear the most?

Well, everyone needs to hear it. Sure, throwing all your money into a new craze can be financial suicide. The real lesson, though, is never to consider any business or industry to be totally failsafe.

If the received wisdom is that something grows and grows, that people will always need it, remember that everything changes in the end. And we can’t fully tell when this will happen.

Investors have considered themselves savvy for putting all their money into a single ‘safe bet’. That safe bet might decline oh-so-gradually over the years, but you trust it will pick back up, right? What if it doesn’t? Always spread your risks.

3) Avoid Knee-Jerk Reactions (Mostly)

This advice may seem to contradict the previous point, but in many cases, a sudden sell-off doesn’t mean the end. Consider the aviation industry. During past global recessions, many considered the aviation industry to be doomed and sold their stock in airlines. Indeed, some companies may well die off. But that’s not a reason to write off the whole industry.

Of course, buying back when stock prices hit their lowest is a savvy move. But that’s hard to predict, and if you’re set to lose out by selling off due to a sudden dip, it may be a good idea to hold your horses. Consider the resilience of your investment choices and carefully imagine their future. It may be worth sticking it out.

4) Embrace Change

Markets are always changing. Perceived needs are ever-changing. Keeping abreast of social developments is a must if you’re looking for significant short-term gains, but also if you’re playing the long game.

The Takeaway

Remember: the long game is still playing for profit, and betting that a company will never, ever fail isn’t a safe bet. If you’re looking for safe, savvy investments, look for the new businesses that will stand the test of time. Embrace the new. And best of luck!