In a previous post, Nuwire writer Eric Ames profiled “The Infinite Banking Concept“. This was a followup post to an article titled: The Infinite Banking Concept: Be Your Own Bank. I’d like to provide a fresh perspective on this concept, because I believe that it’s being overcomplicated by many well-meaning advocates.

What Is The Banking Concept?

Short version: It’s the idea that you can eliminate the use of banks and credit card companies for most (sometimes all) loans and just borrow money from yourself instead. When you do this, you earn the interest a bank would make off you.

The banking business is thousands of years old, but the idea of “becoming your own banker” originated with a guy named Nelson Nash (at least, this is what the marketing literature says).

If you search for “Infinite Banking” on the Internet, you’ll find the most popular advocates of this concept are R. Nelson Nash (“The Infinite Banking Concept”), Pamela Yellen (“Bank On Yourself”), Jeffery Reeves (“YouBeTheBank”), and Don Blanton (“Circle of Wealth”). Every advocate has, up to this point, been able to explain the concept with varying degrees of success.

The concept, in it’s simplest form, is this: create your own private “banking system,” of sorts, by saving up some money somewhere. Then, use this pool of money to finance everything in your life. If you think about it, it makes perfect sense. Regardless of what you do in life, whether you spend your money or you invest it, you have to use a banking system to facilitate the transaction. All of the money in the world goes through someone’s bank. Advocates of the banking concept argue that you should just set up a “private bank” of your own and use that.

Sounds sensible. Let’s try it.

Using Dividend-Paying Whole Life Insurance

Nash, et al. often claim that “banking is a process, not a product,” and I agree. You technically don’t need to use life insurance to pull this off, but most everyone you talk to will tell you it’s a good idea to use it. They’re not wrong, either.

If you use a simple checking account, the process is dead-simple: build up a savings, borrow from yourself, repay yourself with the interest a bank or credit card company would charge you. You earn the interest a lender would have made off you.

So, why use a life insurance policy? Because… life insurance takes the basic idea and adds a guaranteed growth rate, (non-guaranteed) dividends, a death benefit, and attractive loan rates to the mix. In other words, it takes the basic idea and makes it much, much better without introducing undue risk.

Some critics argue you could do better than using whole life. The fact of the matter is it’s not literally impossible to do this by buying a term life insurance policy and investing the money you’d save by not buying a whole life policy (called “buy term and invest the difference”). It’s just impractical for most people to do it, and do it with the same efficiency as a whole life policy.

The basic problem with using investments to do this is… it’s very easy to lose a lot of money because you introduce a lot of risk. You could be upside down on your loans, your savings could lose value, and moving in and out of investments creates a lot of transaction costs that you won’t have with an insurance policy. Also, if you cash out of investments to “borrow” from yourself (instead of using loans), you lose interest on your savings until you fully repay yourself.

Also… there’s nothing wrong with having a secure savings-like vehicle like life insurance. It’s like a foundation for a home. You build the foundation (insurance). Then you build the house (investments). If the house falls down, well at least you have something from which to rebuild. Enter whole life insurance.

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

Whole life insurance allows you to integrate insurance and a savings function (the cash value, which is not technically savings but rather equity in the contract). The cash value replaces the pure insurance (the death benefit) over time and does it on a guaranteed basis. Some life insurance companies take this one step further and offer potential for you to earn dividends (which are not guaranteed to be paid) on the policy which can grow the death benefit and cash value over time. Once earned, you can never lose the dividend payment or corresponding cash value.

When actuaries describe life insurance, they describe it in terms of an indivisible contract. There is no actual separation of cash value and death benefit. So a $100,000 insurance policy, with $50,000 of cash value, means that you have $50,000 of pure insurance (not $100,000). The total contract, however, is worth $100,000 ($50,000 of cash value + $50,000 of pure insurance).

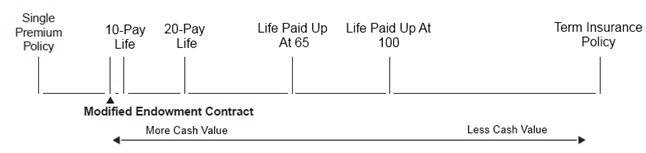

Think of insurance contracts as existing on a continuum. On the far right-hand side of the field, we have term life insurance. You pay low premiums and you have no cash value. Moving on over to the other side of the field is a single-premium policy. You pay one outrageous premium payment and have that amount available immediately as cash value in the policy. You’ll notice that, as you move beyond the term life product, these policies become a combined savings and insurance contract. Somewhere along the way to riches, fame, and power, we run into the MEC guideline:

A modified endowment contract (called a “MEC”) is IRS-speak for a life insurance policy that has failed the Guideline Premium Test (GPT) or the Cash Value Accumulation Test (CVAT) outlined in the tax code at IRC section 7702. If you fund your policy so heavily with premiums that it crosses that MEC line, then the IRS will reclassify your life insurance contract as an investment, and all withdrawals and policy loans will be subject to income tax.

No good.

Your access to cash values will also be restricted prior to age 59 1/2 (basically, your policy will be treated as a non-qualified retirement account). In other words, it destroys the flexibility and advantages of the policy.

Policy Loans

In order to do this banking concept thing, you are going to need access to all of those cash values. You do this through the built-in policy loan feature of your contract. Policy loans are very different from traditional bank loans. First, there is no credit application and your loan is only limited by the amount of cash value you have available in the policy.

Secondly, there is no set repayment period. You choose the terms of the repayment. You may even keep the loan open until your death. If you do, the insurance company will simply deduct the loan amount from your death benefit and pay your beneficiaries the remainder. When you want to take out a policy loan, you simply call up the insurer and request a policy loan. The insurance company issues the loan, and then secures the loan amount with an equal amount of death benefit (some insurers say they secure the cash value) from your policy.

For example, if you have $100,000 in cash value in your policy, and you want a $10,000 loan, the insurer will give you $10,000 and then secure the loan with $10,000 from your policy. This leaves $90,000 available for future loans. As you repay the loan, your cash value is restored with each payment. What’s really special about these loans is that the insurer will continue to pay interest and dividends on the original $100,000 amount if you set up the loan provisions properly when you first set up the policy contract.

Some insurers change the dividend payout by lowering or raising it on any loaned cash value, while other insurers keep the dividend the same regardless of loan activity. You’ll hear the former referred to as “direct recognition” and the latter as “non-direct recognition.”

Some insurance agents will tout the benefits of non-direct recognition heavily but don’t drink the Kool-Aid. There’s no magic here. With non-direct recognition, an insurer can afford to keep the dividend the same on loaned cash value because it either raises expenses in the policy or lowers the dividend they could otherwise pay to everyone, all the time (which slightly favors people who are taking loans all the time). It’s not a big deal, but something to be aware of.

How Nash, Yellen, and Others Do It

There are many advocates of the Infinite Banking Concept out there. R. Neslon Nash was the first. Others followed, like Pamela Yellen (“Bank on Yourself”), Don Blanton (“Circle of Wealth”), Jeffery Reeves (“You Be The Bank”), Douglas Andrews (that “Missed Fortune” guy) and sometimes the folks over there at L.E.A.P.

Most advocates of the banking concept tell you to use a “life paid up at 65” policy or maybe a “life paid up at 100” or something similar. In order to build up the cash value quickly, you have to do something called “overfunding” the policy. This is done by adding a special rider to the policy called a “paid-up additions” rider.

The rider modifies the contract to allow additional premium payments to be made. The additional premium payments go directly towards buying paid-up life insurance death benefit which has its own cash value and generates its own dividend. There are no (or very small) commission payments paid to the agent on this additional insurance so the cash value for the additional paid-up insurance grows rather quickly.

The problem with this method isn’t that it can’t be done. It’s that it’s complicated and difficult for the average insurance agent to follow. The client doesn’t need to know a lot about policy design, but the agent sure as heck does. And, you need a very knowledgeable agent to help you. Agents which are in short supply.

And even if an agent has heard of the concept, it doesn’t mean they will actually help you implement it. And even if they want to help you implement it, it doesn’t mean they have the chops to pull it off.

“Overfunding” a policy requires an understanding of what a modified endowment contract is, how to take policy loans and repay them with a paid-up additions rider on the policy, and monitoring how much money you’re paying towards the additional paid-up insurance rider when there is no loan outstanding so that the insurer doesn’t cancel the rider (most insurers will cancel the paid-up additions rider if you don’t use it after a certain period of time, though I’ve never heard an insurance agent adequately explain this to a client).

I have, however, personally seen agents butcher policy designs trying to set up one of these policies. It’s not pretty and the client won’t know until it’s too late.

Does this mean you shouldn’t ever buy a custom whole life policy? No, it does not. It just means you should make sure you’re working with a specialist. It’s like this… if you wanted a custom piece of wood furniture, you’d hire a master carpenter or a woodworking expert. You wouldn’t hire a weekend handyman because he’ll butcher the job. Same thing here.

Now let’s have a look at how to actually implement this insurance plan and make it work.

Part 2: A Simpler, and More Efficient, Way To Implement The Banking Concept

Author Bio

David Lewis is the founder of Monegenix®, a company specializing in an educational approach to insurance-based financial planning. David also designs custom life insurance and cash flow plans for small business owners and professionals. For more information, go to www.monegenix.com.