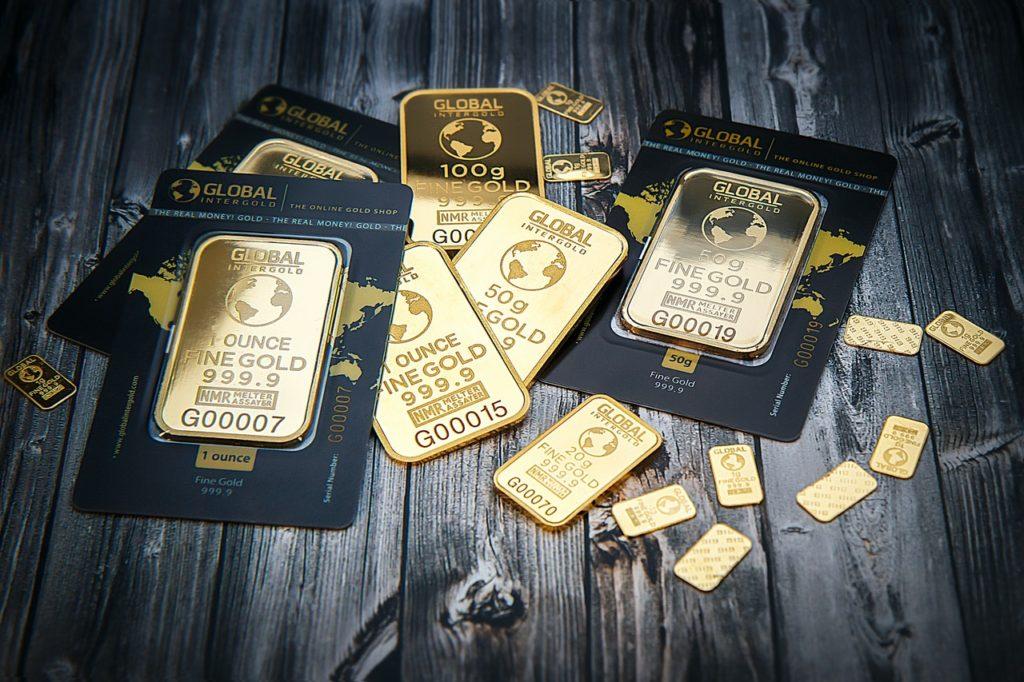

Gold has a long history of being used as a currency, jewelry, or tradable asset. From ancient civilization until our current society, gold remains an object of fascination to many people. The value of gold has remained considerably high compared to other precious metals since ancient times. Some investors take interest in gold for its efficiency as a hedge against inflation. Others invest in gold to diversify their portfolio. Others consider gold as currency. As diverse as gold may seem, investors will ask if it is an excellent individual retirement account (IRA) investment. Read to know what experts say about it.

It Can Help Diversify Your Retirement Portfolio

It Can Help Diversify Your Retirement Portfolio

There is a growing interest in gold due to its steadily increasing price for the past 50 years. Gold moves in the opposite direction as the U.S. dollar or any paper assets you may have because the metal is dollar-dominated. This inverse relationship means that gold can be an effective hedge against inflation. The 2008 financial crisis and the more recent Great Recession that happened after have brought the interest in gold IRA to newer heights. Gold IRA firms have emerged and become popular service providers in the past few decades. Before you decide to invest in gold IRA, you have to note that not all gold or silver IRA firms are created equal, and they may have different policies and approaches to investments in precious metals. Check if the company has more than one review from independent platforms or reviewers. More reviews mean you have more references to the reputation and business approach of the firm. Customer reviews can also be reliable references to how well they cater to the needs of customers and if they have excellent customer service.

Gold Offers Protection from Deflation and Inflation

While investors generally consider gold as an inflation hedge, it also provides reliable protection against deflation or the decline in prices of goods and services. Inflation usually takes place when there is an increase in money supply, deflation is a result of a decrease in the supply of money. In both situations, gold remains stable and retains or increases its price depending on the global market movement. While some investors hesitate to include a gold-backed IRA due to the limitations of gold ownership, there is nothing stopping you from also holding other assets in a self-directed IRA. Gold IRA is not just limited to investing in physical gold. There are indirect ways of investing in gold and precious metals without the complexities surrounding physical ownership of gold precious metal coins or bullion. Many US investors invest their IRAs in stocks, which can be gold ETFs,mutual funds, gold miners, gold supply chain companies, and others. Unlike what other investors think, gold IRA has some degree of flexibility, which can be helpful in stabilizing your retirement funds even in unstable economic situations.

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

A Gold IRA Can Be Costly

If you want to invest in a gold IRA, you have to be prepared for the special expenses that come with owning gold assets. It can come with a seller’s fee, retirement account setup fee, custodian fees, and storage fees, which may reach up to $250 each year for storage and insurance only.

An easier and more cost-effective way to own gold is through exchange-traded funds (ETFs). These funds are trusts that own vast quantities of gold. Gold ETFs have low operating costs and have no minimum investment except for the cost of a single share, which is reasonably priced at around $5 to $120.

Gold can be a versatile metal when used smartly as an investment. A gold IRA is not for every investor. Some can make the best investment strategies that include gold assets, and others can’t. Nevertheless, gold is still a reliable inflation hedge and portfolio diversifier. Consult a financial advisor on how you can best utilize gold IRA investments to fit the goals of your portfolio.

Gold can be a versatile metal when used smartly as an investment. A gold IRA is not for every investor. Some can make the best investment strategies that include gold assets, and others can’t. Nevertheless, gold is still a reliable inflation hedge and portfolio diversifier. Consult a financial advisor on how you can best utilize gold IRA investments to fit the goals of your portfolio.