Whole Life Insurance Policy Loans: How To Pay Off Debt And Save Money For Your Future At The Same Time

According to the Federal Reserve, consumer debt was approaching $14 trillion after the second quarter of 2019. And while that debt has, no doubt, financed some very fine lifestyles, it has also made it more difficult to save money.

Take college loans, for example.

Student loans look like a good deal to young folks just starting out, but there’s a lot of little “gotchas” that turn these non-conventional loans into a nightmare. First of all, the federal government sets the rates for a lot of student loans because these loans are subsidized loans. Even unsubsidized loans are set by the government.

According to Value Penguin, the 2019-2020 federal student loan interest rates have fallen from previous years, but still range between 3% and 7%.

The True Cost Of Student Loans

One problem in figuring out the real cost of these loans is the fact that there are fees attached to most federal loans coupled with the fact that student loans don’t amortize in the way other conventional loans do.

Fees are charged on each dispersal to the student, and interest accrues daily. Interest is always paid before principal. If the loan payment is insufficient to pay the interest, the interest gets added to the principal, creating negative amortization, where interest starts to compound against the student.

No wonder students have such a hard time paying off their debt and saving money for their future.

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

Paying Off Student Loans (and other debts) With Whole Life Insurance

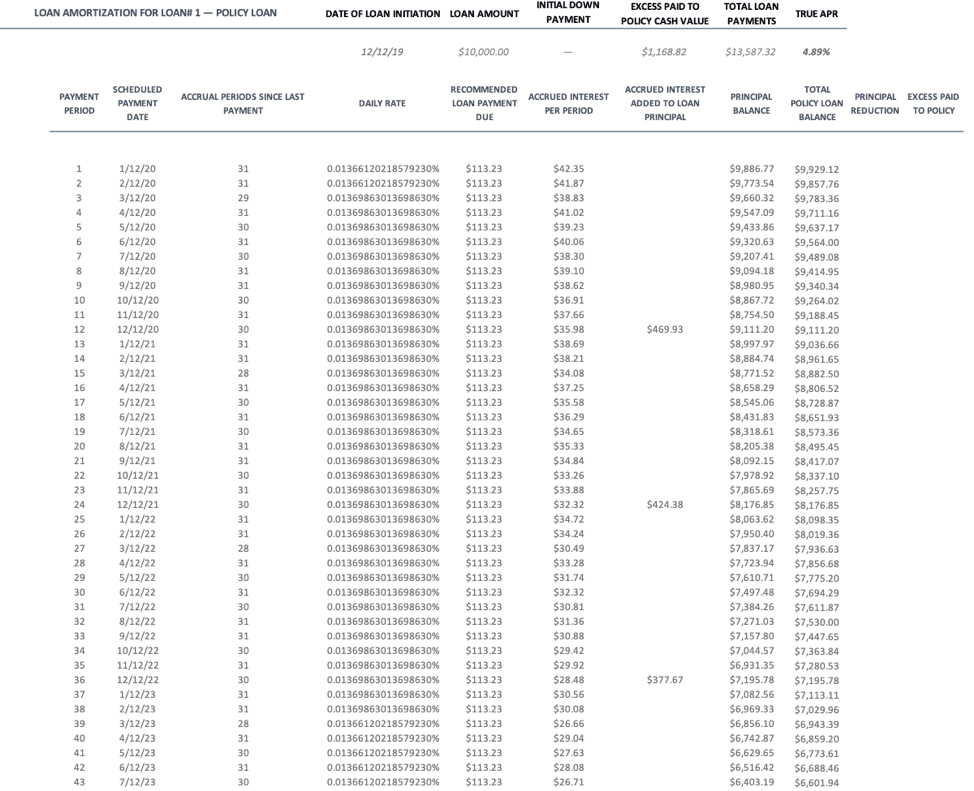

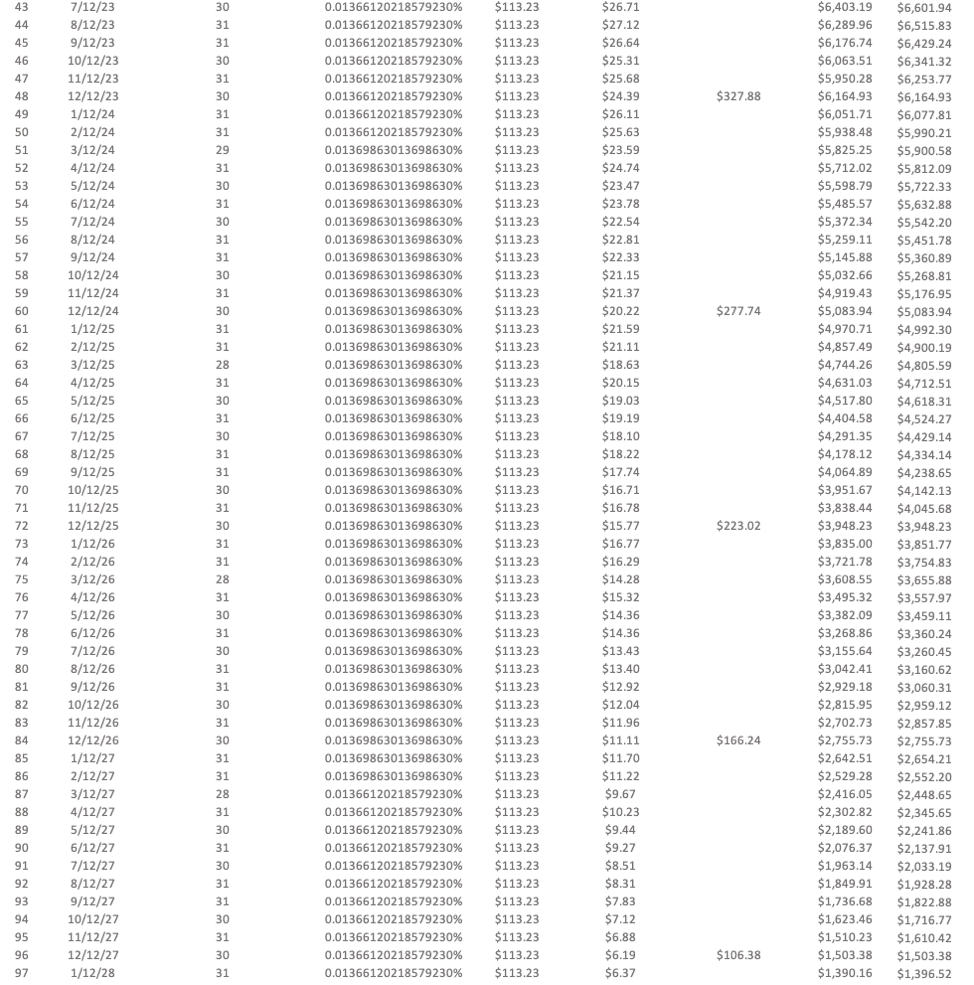

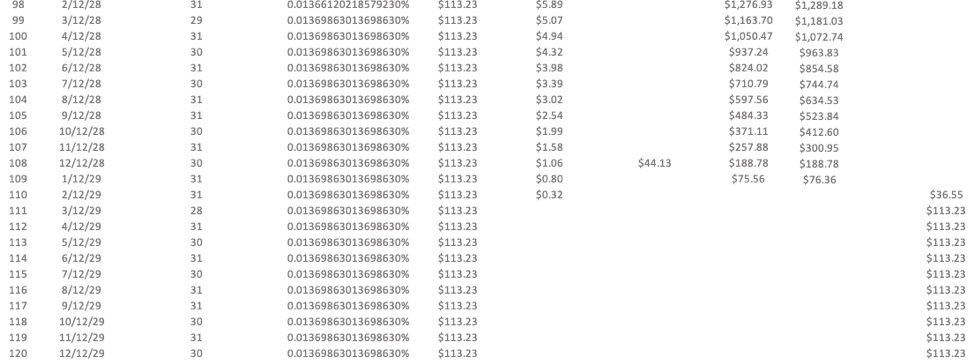

A direct unsubsidized loan for professionals or graduates comes at an advertised cost of 6.08% APR. But, with fees, the true cost of the loan over 10 years is 6.437%. If a student chooses to pay off their student debt using the standard repayment schedule, a $10,000 federal student loan can result in $3,587.32 of total interest paid over that 10 year time period.

What if you could put $1,168.82 of that interest right back into your own pocket, and pay off your loan faster?

Lenders say it can’t be done. Reality says it can.

By refinancing your student loan debt through a new or existing high cash value, whole life insurance policy, and paying the same 6.437% APR on your whole life policy loan, a policyholder can substantially reduce your interest payments on your student loans while simultaneously growing your cash value savings inside the policy — savings which can be used to pay off other debts and further accelerate the growth of your savings.

Here’s how it works:

As you can see, whole life insurance policy loans are different from conventional loans. You are not paying interest before loan principal. You are paying principal before interest.

Instead of being fully amortized, these policy loans are non-amortizing. This means the insurance company doesn’t expect you to make any specific payment amount. Instead, it leaves the repayment schedule up to you, charges interest based on the current outstanding principal amount, and bills you for the interest on any remaining principal amount at the end of the year. To reiterate, if you make your own repayment schedule, and faithfully repay your policy loan, you repay the principal of the loan before paying interest during the year. This allows you to control the amount of interest you pay to the insurance company.

In the above illustration, interest is allowed to be added to the outstanding principal balance of the policy loan. But, because regular monthly payments are being made, the policy loan is still paid off early. Even though the life insurance company advertises a policy loan rate of 5% APR, this policyholder actually pays a policy loan APR of only 4.89%. The policy loan interest is paid to the life insurance company, becomes investment income to the insurance company, and is later repaid to the policyholder as a dividend on a participating whole life insurance policy — further reducing the net cost of the loan.

Meanwhile, the policyholder keeps repaying his policy loan at the same rate his old lender was charging him for the student loan. Once the policy loan principal is repaid in full, payments continue until the end of the original 10-year term. The extra payments buy additional paid up life insurance through a paid-up additions rider, boosting the cash value of the policy and dividends. The process can then be repeated with other loans. Each time this is done, the cash value savings grows, making easier and easier to save money for the future while — at the same time — paying off crushing student loan debt.

If this sounds familiar, it’s because the basic process is similar to the Infinite Banking Concept described in an earlier article. If a custom whole life insurance policy is used to repay personal and business debts, and to finance new purchases, the possibilities for future savings growth are near-endless.

Author Bio

David C Lewis, RFC is an independent life insurance agent, a Registered Financial Consultant, and the founder of Monegenix®. For more information about using whole life insurance to make major purchases and grow your personal savings, go to www.monegenix.com.