The speculative foreign exchange markets can be fast-moving, especially during a period of volatility like the current pandemic-influenced economic environment. All sorts of things can affect the movement of the markets, including significant news announcements from central banks or incidents of political uncertainty like general elections. As a trader, you need to react to these when making your market entry and exit decisions. Here’s how to go about timing your moves.

Look for news events

Traders who take what is known as a “fundamental analysis” approach to forex trading are likely to structure their entry and exit decisions around the wider economic context, perhaps by monitoring the news or economic calendars which indicate what is going on. This technique is often used for timing entry. If a trader’s analysis of price charts has shown that a particular currency is prone to faltering in the run-up to its central bank making an interest rate decision, they might take the view that existing positions should be closed beforehand.

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

Price charts only

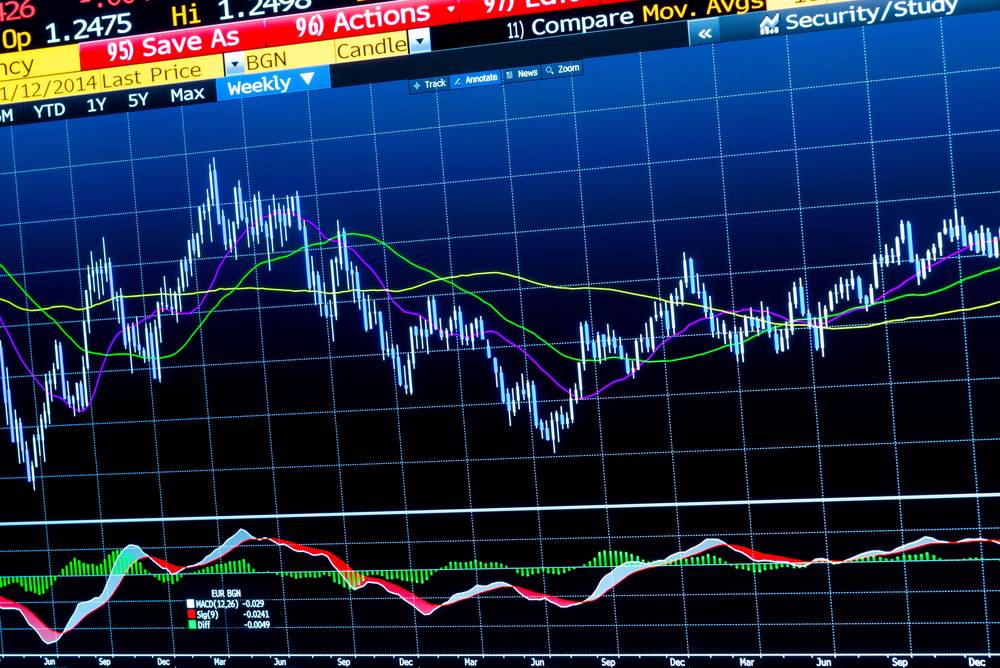

Other traders take what is called a “technical analysis” approach to the forex markets. That refers to price chart data, and tools such as MetaTrader can be used to assess how a currency has moved in the past and how it might move in the future. Traders can use this sort of software to look for particular patterns that might indicate future movements – and while there is never any guarantee of future returns based on past performance, an experienced trader can identify price movements with ease. When reading broker reviews, it’s worth checking out whether they offer MetaTrader or similar – and if no software meets your needs, it may be worth looking for another broker.

Use order execution tools

In terms of exit, a forex trader also has a series of order execution tools at their disposal that they can use to specify how and when a trade is closed. A stop-loss, for example, allows a trader to specify the point at which their position will close if they are making a loss – meaning that the trade can be approached in a “set and forget” manner even if the trader is not actually online to initiate the exit. The benefit of a stop-loss or similar is that it removes the need for ad-hoc decisions about timing. It allows a trader to set their maximum level of loss (or their minimum level of potential gain) well in advance and to take the instantaneous, emotional aspect of the exit decision out of the equation.

The timing of market entry and exit is a strategic decision for a trader to make – and if you get it wrong, it could have disastrous consequences. But with price charts, news sources, and order execution tools on side, it’s possible to increase the chances of making the right decision.