ZenLedger Review: Pros, Cons, and More

ZenLedger

- Crypto tax software integrating with hundreds of wallets

- Generate crypto asset taxes

- Supports over 400+ exchanges

Pros:

- Trusted by IRS

- Having DeFi and NFT support

- Tax-loss harvesting feature

- 1-year refund policy

Cons:

- Limited features for basic accounts

- Limited global availability

- Not affordable

ZenLedger Ratings and Reviews

ZenLedger is a cryptocurrency tax software enabling individuals and tax professionals to track their trades, calculate their taxes on crypto assets and see their Profits/Losses. The tax software supports over 400+ exchanges, including 100+ DeFi protocols and 10+ NFT platforms[1], such as Binance, Coinbase, Kraken, and Ledger.

Trusted by the Department of the Treasury Internal Revenue Service (IRS) and Turbotax, ZenLedger generates tax forms, including Form 8949, Schedule 1, and Schedule D, when its users import their exchanges and wallets via read-only API, CSV, or public receiving address.

ZenLedger offers top-notch customer service to its 50K customers[2], and the platform’s main selling point is the Grand Unified Accounting feature which is unique to the software. While the platform simplifies DeFi, NFT, and crypto taxes for investors and tax professionals, it also provides a crypto tax-loss harvesting tool.

ZenLedger works with all major crypto and fiat currencies, such as Bitcoin, Ethereum, DogeCoin, Tether (USDT), and more. The platform also helps its customers to identify any missing cryptocurrency transactions with its custom-built resolution center.

Source: HomePage ZenLedger: https://www.zenledger.io/

Source: HomePage ZenLedger: https://www.zenledger.io/ Highlights of ZenLedger

- Trusted by IRS: ZenLedger is the IRS’ preferred provider[3] of forensic accounting and taxation software for cryptocurrencies.

- NFT and DeFi support: ZenLedger is one of the few crypto tax software platforms[4] having DeFi, and NFT support integrated into various exchanges and marketplaces.

- Tax-loss harvesting: The platform’s tax-loss harvesting feature automatically analyzes users’ trade histories and offers solutions to minimize taxes.

- Grand Unified Accounting: Unique to ZenLedger, the GUA feature of the platform enables its users to see their entire transaction history across all their wallets and exchanges in one easy-to-read spreadsheet.

- Tax Professional: ZenLedger provides their users’ transactions and tax forms in one easy-to-use dashboard for their tax professionals for free.

- 1-year refund policy: ZenLedger offers a 1-year refund policy for its users who aren’t satisfied with the platform’s services.

- Customer support: The platform provides high-quality customer services to its users.

Risks of using ZenLedger

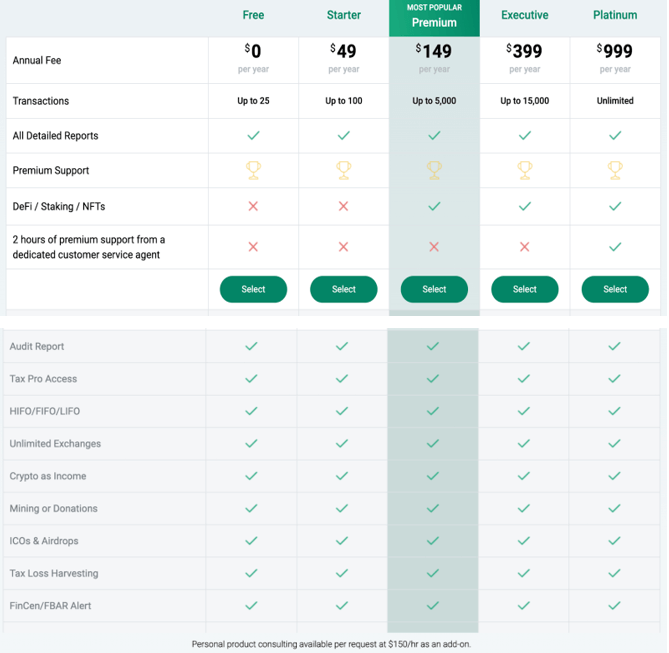

- Limited features for basic accounts: ZenLedger has five different account types with various features. Users with a free plan can only review up to 25 transactions and have no support for DeFi, staking, and NFTs.

- Refund policy: Even though ZenLegder offers a 1-year refund policy for its users, the company can refuse the refund request or only issue a partial refund if their users don’t download the tax forms or CSV files.

- Limited global availability: ZenLedger can be used by anyone in the world having multiple ledgers and would like to know more about their transactions. However, localized tax form support is only available for US citizens.

- Pricing: ZenLedger is one of the most expensive crypto tax platforms. Pricing can be up to $900 per year for users who want unlimited transaction options.

ZenLedger Features

ZenLedger has one of the most comprehensive cryptocurrency tax calculators on the crypto market. The IRS-friendly platform can generate Schedule 1, Schedule D, and IRS Form 8949, easily linking with its users’ wallets or exchanges.

The most outstanding features of ZenLedger are Crypto Tax-Loss Harvesting Tool and Grand Unified Spreadsheet. ZenLedger creates a list of tax-saving opportunities for its users reviewing their trade history thanks to its tax-loss harvesting tool analysis. With Grand Unified Spreadsheet, users can monitor their entire transaction history in one easy-to-read spreadsheet and make wiser decisions.

ZenLegders monitors not only cryptocurrency but also NFT, DeFi, staking, and Margin trading transactions for its users to file their taxes.

ZenLedger easily integrates with TurboTax, one of the most popular programs used by those filing taxes for themselves.

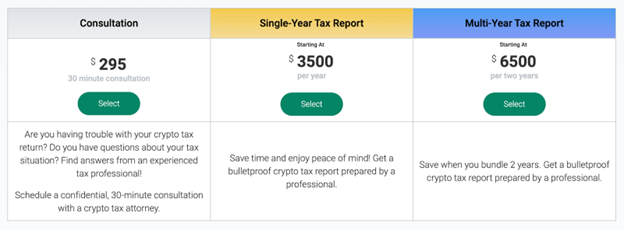

ZenLedger provides on-demand customer service with its in-house support team available for questions seven days a week. Additionally, the platform connects tax professionals with its users to offer professional help to complete crypto and non-crypto taxes quickly. Users can schedule a confidential call with a crypto tax attorney or professional. They can also buy extensive bulletproof crypto tax reports prepared by a professional.

The software platform also has a newly-launched mobile app available on iOS and Android.

ZenLedger Pricing & Fees

ZenLedger offers various subscription plans that can be custom or prepared. The platform targets to meet its users’ specific taxation needs for crypto, NFT, and DeFi transactions with different options. ZenLedger also provides tax professional prepared plans, consultation calls, and tax reports with various pricing.

ZenLedger Crypto Tax Software Plans Pricing (Source: https://www.zenledger.io/pricing#regular-prices )

ZenLedger Crypto Tax Software Plans Pricing (Source: https://www.zenledger.io/pricing#regular-prices )  ZenLedger Tax Professional Prepared Plans (Source: https://www.zenledger.io/pricing#regular-prices )

ZenLedger Tax Professional Prepared Plans (Source: https://www.zenledger.io/pricing#regular-prices ) ZenLedger Company Background

ZenLedger was founded in 2017 in Seattle, USA, by Bryan Starbuck, Drew Nordstrom, Patrick Larsen, and Saqib Rasool. Built by industry veterans in technology, finance, and accounting, ZenLedger has quickly become the leading cryptocurrency tax and accounting suite for investors and tax professionals.

Backed by investors including blockchain venture funds, crypto founders, and leading crypto & fintech venture capital firms such as Parafi, Mark Cuban, AVAX Blizzard fund, and ALGO Borderless Capital, ZenLedger analyzes and accounts user transactions across thousands of exchanges, NFTs, DeFi, wallets, and tokens in one simple dashboard.

ZenLedger also supplies blockchain protocols, investment funds, corporations, and governments with the tools needed for taxation, accounting, investigation, and audits.

In 2022, ZenLedger raised $15 Million in Series B[5]. The company also launched its mobile app and partnered with Bitpay[6] to accept cryptocurrency payments on its platform.

How does ZenLedger Work?

Thanks to its straightforward design, ZenLedger makes it easy to set up an account so users can do their taxes. To start, users can sign up with their Google or Coinbase account and choose a subscription plan of their preference. Once they have access to the ZenLedger dashboard, users can import their transaction and trading history via read-only API, CSV, manually, or public receiving address. After importing data, users can generate tax forms and download them to send to their CPAs or IRS. Users can also invite their CPA on the ZenLedger dashboard.

Users with a tax professional prepared plan can connect with a crypto tax attorney or professional to get help.

ZenLedger Supported Crypto Exchanges

ZenLedger supports over 400 exchanges that include:

- Coinbase and Coinbase Pro

- Binance and Binance.US

- UniSwap

- CashApp

- Bittrex

- Bitfinex

- eToro

- Huobi

- Okcoin

- Nexo

A complete list of ZenLedger’s supported crypto exchanges can be found on the company’s website in the Integration section.

ZenLedger Supported Wallets

ZenLedger integrates both with the major hardware and software wallets, including:

- TrustWallet

- MetaMask

- Ledger

- Trezor

- Bitpay

- Exodus

- Mycelium

- Jaxx

- MyEtherWallet

- Edge

More details on support wallets can be found on the company’s website.

Security: Is ZenLedger Safe & Secure?

ZenLedger is a secure platform that has never reported a hack issue or security breach since its foundation. ZenLedger uses HTTPS and TLS 1.2 encryption on its website. The company’s servers reside in a VPC (Virtual Private Cloud) and can not be directly accessed from anywhere. ZenLegder has Amazon Guard Duty enabled to access and report vulnerabilities.

ZenLegder states that they don’t comply with KYC/AML requirements since the company isn’t an exchange. The platform also doesn’t report its users’ financial information to any organization. ZenDesk doesn’t require users to share their private keys with the company. The company only requests READ ONLY access to generate tax forms with transaction history.

Customer Support: Contacts & How to Get Help

ZenLedger’s exceptional customer support is available for all users. Users who want extensive customer support can purchase a Platinum plan, which offers 2 hours of premium support from a dedicated customer service agent.

Users can contact ZenLedger in three ways:

Through Live Chat: Customer Success representatives reply to users’ questions between 9 am-9 pm ET, seven days a week. ZenLedger typically responds in fewer than 10 minutes during business hours.

By email: Users can email hello@zenledger.io to receive same-day support or find responses to non-urgent questions.

By phone: ZenLedger users can call or text (877) ZEN-TAXS (877-936-8297). Customer success team returns within one business day.

Additionally, ZenDesk provides comprehensive learning sources and knowledgebase combining their blog, support center, recorded webinars, and crypto tax guide.

Who is ZenLedger Best For?

For those who are new to crypto taxes or the cryptocurrency ecosystem, ZenLedger is one of the best solutions on the market. The platform’s user-friendly design, tools, and solutions simplify the complicated taxation process. Also, consulting a crypto tax attorney or professional through the platform can help users file their crypto taxes.

ZenLedger has very responsive customer support available to every user. The software platform and its app can be downloaded and used all over the world. However, localized tax documents are only available to U.S. citizens.

Trusted by the IRS, ZenLedger provides a secure platform for crypto traders and doesn’t share its users’ data with third parties.

For those who are unsure if ZenLedger is the best option, the platform also helps their potential users with a Competitive Comparison webpage on their website.